What is Litigation Funding?

Innovative finance providing a no-cure, no-pay and no-risk solution to claimants.

Introduction to: Litigation Funding

Litigation funding, also known as ‘Third Party Funding’ or ‘Litigation Finance’, is a form of funding in which a third-party funder provides financial resources to a claimant or plaintiff in a legal case in exchange for a financial return in the event the case is successful, which can take the form of a share of the proceeds or an agreed return on the funder’s investment.

As a form of non-recourse finance, if the case is lost, the litigation funder receives nothing and loses its investment (‘no cure, no pay’).

The concept of litigation funding has existed for centuries, with wealthy individuals or organisations providing funds to support litigation in exchange for a share of the potential winnings. In recent decades, however, the industry has experienced significant growth and expansion, which is reflected by the increasing number of funders and funding solutions now available within the market.

Litigation funding can be a valuable tool for claimants or plaintiffs who are unable to bear the costs of litigation independently. The costs of legal representation, court fees, and other expenses can add up quickly, and despite having a strong case, a claimant may not be able to pursue it due to insufficient financial resources. Well-capitalised businesses are also increasingly leveraging litigation funding to optimise the use of their financial resources. Litigation funding can help ‘level the playing field’ by providing claimants with the financial resources needed to pursue a case.

Litigation funding is also used in collective actions where the individual cost for each individual plaintiff would outweigh the benefits. Therefore, using a litigation funding model to bundle the claims enables the claimants to benefit from cost-sharing whilst also shifting the costs and risks to a third-party funder, thus making such claims (and thereby access to justice) economically viable.

Advantages and benefits of litigation funding for businesses

Elimination of Litigation Costs

The most obvious benefit of working with a litigation funding company is that a business can completely remove the cost of litigation from its balance sheet and thus incur no financial risk in undertaking litigation, no matter how complex or lengthy the case might become.

Optimal allocation of working capital

Removal of financial limitations or barriers to pursue litigation

Optimal use of resources within the legal department

Strength by association

Achieving optimal recoveries

A number of the benefits for a business harnessing litigation funding as a strategic business tool are outlined in the following Deminor article:

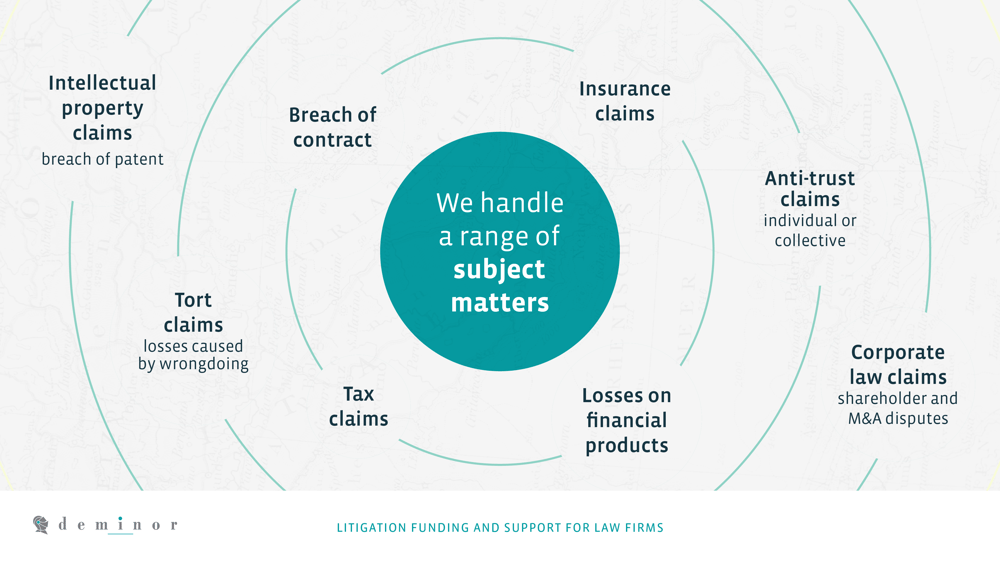

What types of claims can be funded?

No type of claim is excluded from the benefits of litigation funding. As long as the funder believes that the claim has merit and that it can be acted upon in a mutually agreed-upon manner, the funder may propose its services for nearly any type of legal case including, but not limited to:

- Breach of contract

- Corporate law claims (shareholder, M&A and JV disputes)

- Anti-trust claims (individual or collective)

- Losses on financial instruments

- Investment and financial markets claims

- Insurance claims

- Intellectual property claims (breach of patent)

- Tort claims (losses caused by wrongdoing)

- Tax Claims

Claims lacking economic value, such as restraining orders or injunctions in intellectual property cases, are also not excluded, but both parties will have to carefully define the conditions governing the funder’s intervention. In addition, because the litigation funder is only paid upon the successful conclusion of the case, the contract must outline all possible outcomes of the case, identifying what is considered “success”. For claims without economic value, the funder will generally be paid based on a multiple of the total amount invested rather than a percentage of the case proceeds.

Get in touch with one of our experts.

We’ll give you a quick first assessment of your claim.

What costs are covered by litigation funding?

Typically, when a case is funded, it will cover all the fees and costs in connection with the litigation, for example, those listed below:

- Lawyer fees

- Expert fees

- Court costs

- Costs of taking evidence & document collection

- Costs of arbitration institute and arbitrators’ fees

- Security for costs (if applicable)

- Adverse party fees (in case of loss)

- Translation, travel and other out-of-pocket expenses

The objective is to transfer all financial risks of litigation from the litigating company to the litigation funding company.

What types of proceedings can be funded?

Litigation funding can be provided to claimants in:

- Proceedings before the ordinary courts

- Arbitration proceedings

- Alternative dispute resolution proceedings

- Settlement proceedings

- Enforcement proceedings

- Mediation

Funding can be provided at every stage of the proceedings.

Litigation funding case studies

Review our case studies to understand exactly how litigation financing solutions might be applied against various disputes.

Investment Treaty Arbitration - American Corporation v. Asian State

A Breach of Contract Dispute at the International Court of Arbitration

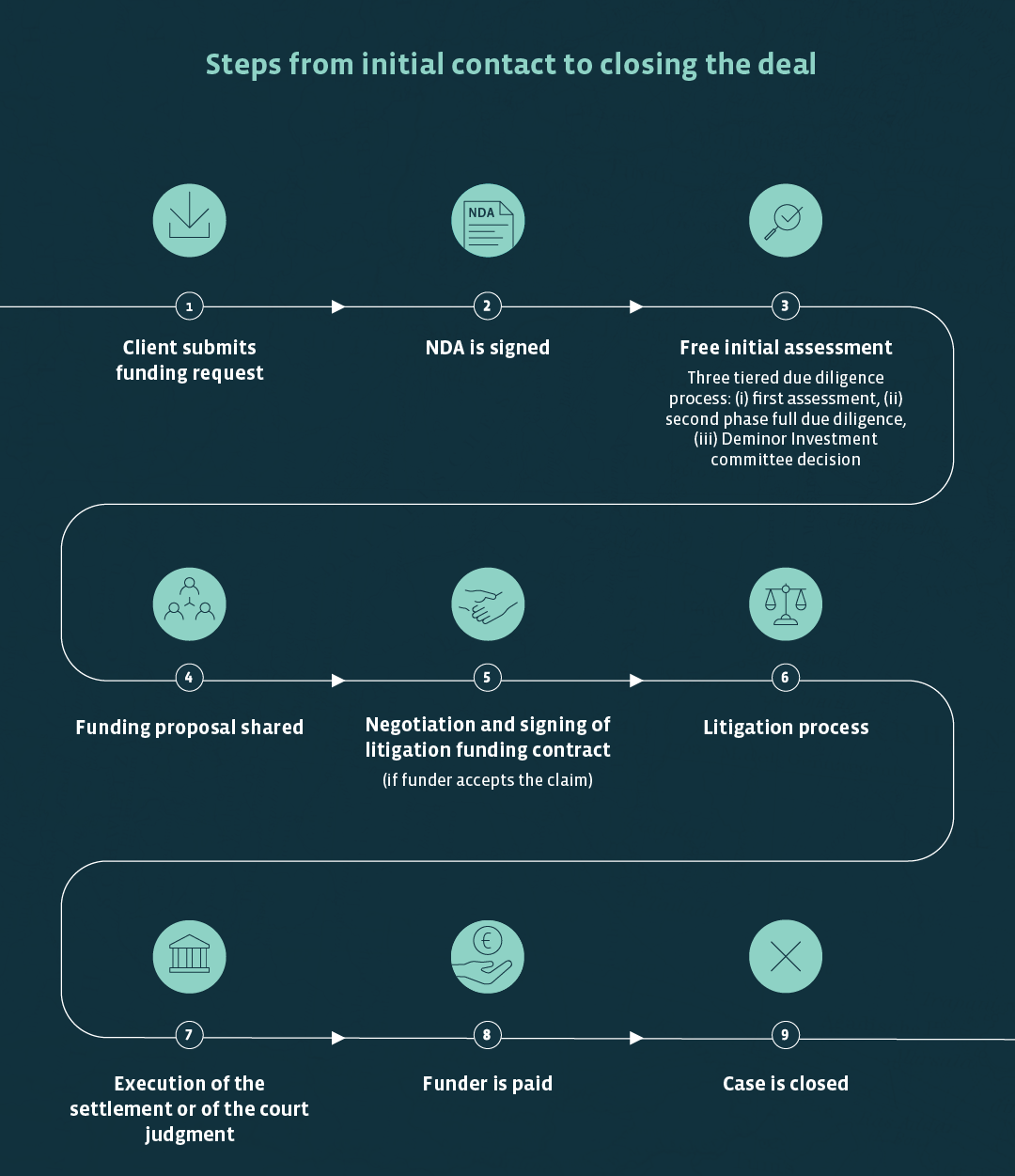

Litigation funding approval process

Taking a potential case from an initial enquiry to being fully funded can be a complex process, and would commonly go through the following steps, which are outlined below:

How does litigation funding work?

Litigation funding works by providing financial resources to claimants or plaintiffs to pursue a legal claim. This funding is provided by a third-party investor, who enters into an agreement with the claimant or a legal representative. The agreement outlines the terms and conditions of the funding, including the percentage of damages awarded or settlement reached that the investor will receive in return for investing in the claim.

Conditions for funding

If a client wants to file a claim (or is being sued, in some cases), the first stage might be to contact more than one litigation funder to find a company that specialises in the claimant’s exact type of dispute. This is because it is common for Litigation Funders to specialise in different types of claims, and therefore, it is in the best interest of the claimant (and their legal representation) to find the funder who is best suited to support their needs.

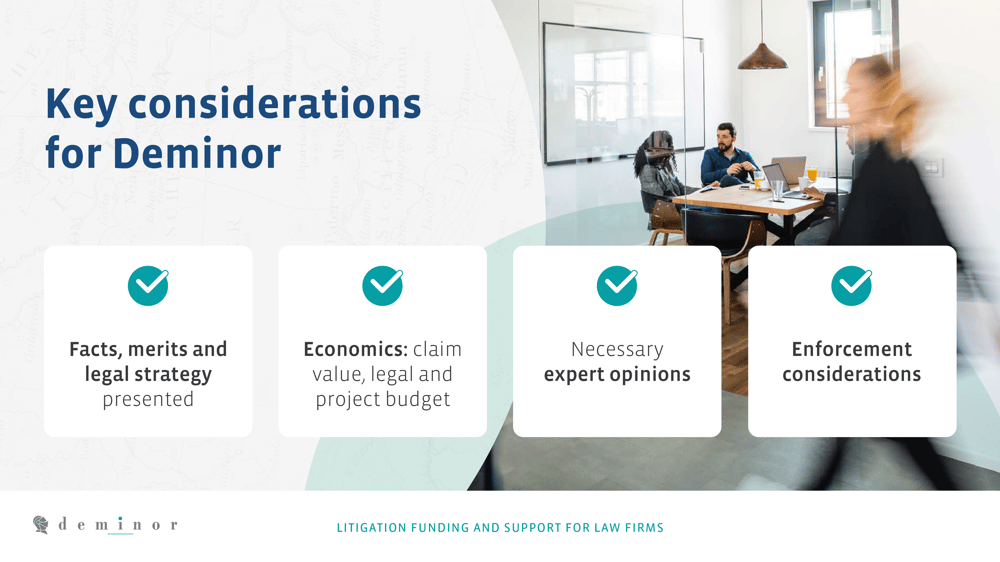

The funder's team will then perform due diligence on the case to determine whether the client has a viable cause of action. The due diligence exercise is typically completed by a team of legal and financial experts and is offered at no cost to the client. At all times, the funder normally remains free to accept or refuse the funding of a claim.

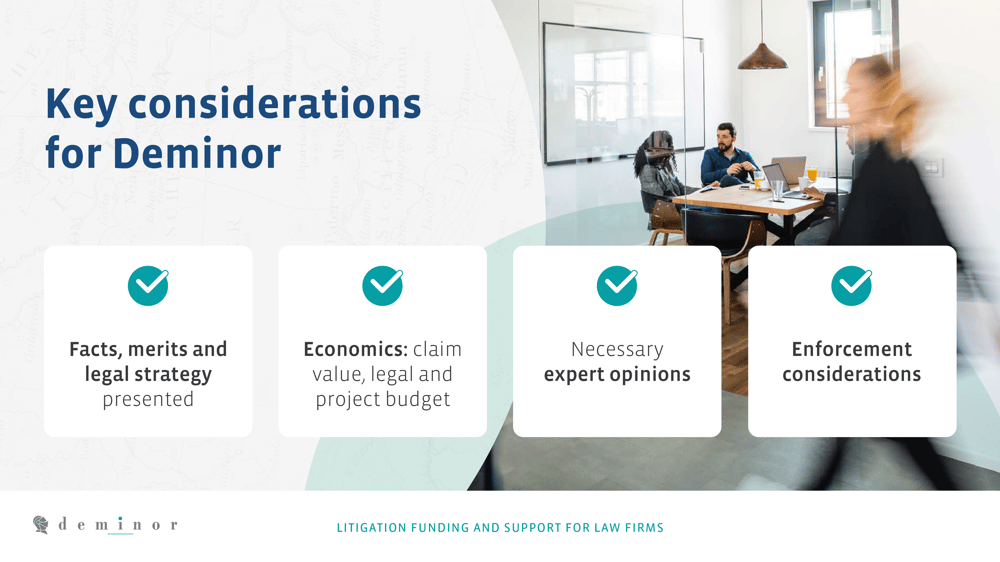

Due diligence process

Due Diligence is carried out in detail by the funder to determine how viable the case is to invest in. Typically, the review encompasses three stages:

- The first phase of due diligence examines the key issues of the claim and proceedings in order to elicit if it is suitable for funding. Depending on the internal skills and experience of the funder, this may be carried out by the internal team, which can have a notable impact on the speed at which an initial decision is made.

- In the event of a positive phase 1 due diligence process, the claim then progresses to phase 2, encompassing detailed due diligence of the proceedings, details and risks of the claim, along with the economics of the investment. At this point, it can be common for a funder to gain the objective view of an independent third-party expert on the merits of the case.

- If a case passes both phases 1 and 2, it is then normally escalated to something commonly referred to as an Investment Committee, where a decision is made to fund and on what terms.

Litigation funding agreement

If a claim successfully completes all stages of due diligence (outlined in the previous section), the funder will then issue what is known as a ‘Litigation Funding Agreement’, in which both parties will discuss and agree on the terms and conditions of the funding, including the remuneration to be received by the litigation funder in the event of a successful outcome to the proceedings.

The remuneration varies per case and will depend on the type of claim, the anticipated duration, its chances of success and its jurisdiction. It is also possible to receive partial funding (covering, for example, only the security for costs or the lawyer’s fees) if the client seeks to limit the funder’s involvement and reduce its fees.

The Litigation Funding Agreement will also define the funder’s role in several phases of the litigation process. In some circumstances, if and when the funder’s input is required, for example, to decide on a settlement or to file an appeal.

The agreement will also be furnished with a typical termination clause. The contract is usually in place for the duration of the litigation, but the client may wish to retain the discretion of early termination. This is a possibility, but the contract must lay out specific conditions for early termination. Under certain well-defined conditions, the funder will ensure its right to cease funding.

Your success is our success:

We are only paid when we win or settle your case.

Deminor handles all litigation costs and receives a percentage of the losses recovered.

Find out more

79.5%

success rate

How to terminate a Litigation Funding Agreement

If a claim successfully completes all stages of due diligence (outlined in the previous section), the funder will then issue what is known as a ‘Litigation Funding Agreement’, in which both parties will discuss and agree on the terms and conditions of the funding, including the remuneration to be received by the litigation funder in the event of a successful outcome to the proceedings.

The remuneration varies per case and will depend on the type of claim, the anticipated duration, its chances of success and its jurisdiction. It is also possible to receive partial funding (covering, for example, only the security for costs or the lawyer’s fees) if the client seeks to limit the funder’s involvement and reduce its fees.

The Litigation Funding Agreement will also define the funder’s role in several phases of the litigation process. In some circumstances, if and when the funder’s input is required, for example, to decide on a settlement or to file an appeal.

The agreement will also be furnished with a typical termination clause. The contract is usually in place for the duration of the litigation, but the client may wish to retain the discretion of early termination. This is a possibility, but the contract must lay out specific conditions for early termination. Under certain well-defined conditions, the funder will ensure its right to cease funding.

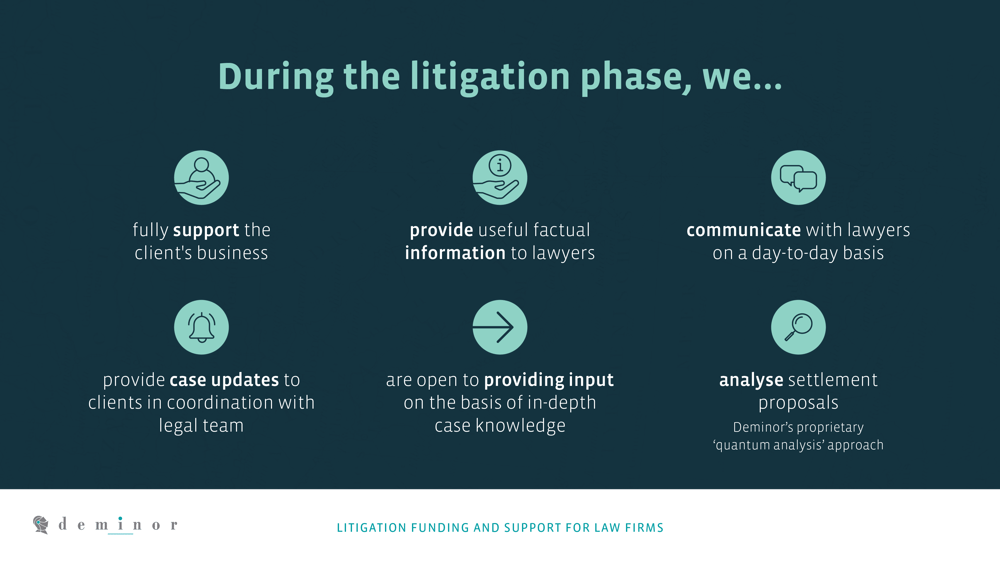

Who manages the litigation?

Usually the role of the litigation funder is limited to providing the financial resources only, with the client managing the litigation with its counsel. It is normally expected to ensure the funder is kept informed about all developments in the case, and may even offer some passive support at the request of the client or its counsel. Strategic decisions that potentially impact funding (and thus, the funder's interests) may, however, require consent.

The client and its counsel will discuss the best decision to make, i.e. whether or not to settle or whether or not to file an appeal. Depending on the contractual terms of the funding, the funder's advice or consent will be required before taking certain decisions which may have a major impact on the funder’s return.

If interests are no longer aligned between the funder and the client, and the client wishes to terminate litigation because of other pressing business matters (such as a possible merger, for example), the client should typically have access to a termination clause and will have to indemnify the funder in accordance with the contractual terms.

How long does a case take?

The length of a case can vary depending on a variety of factors, including the complexity of the legal issues, the amount of damages or settlement sought, and the jurisdiction in which the case is being heard. Some cases may take only a few months to resolve, while others may take several years.

There are two different timelines to consider in litigation funding: the duration of a case, and the duration of the funding agreement. These are often the same but may differ if the client pursues litigation funding after the litigation process has already started.

Case duration

- The duration of a case will depend heavily on the rules and the court system of the jurisdiction where the claim is filed. There may be large differences between countries in terms of the efficiency of courts and tribunals, making it a case-by-case issue. The court systems of most jurisdictions are comprised of three tiers: the Supreme Court, the high courts and the district courts.

- For a commercial B2B claim, it is common for a case to last around four years. The process may go much faster, especially if the parties involved settle before the judge issues a decision – this represents a growing trend in the last few years, stemming from the historical slowness of tribunals. Parties cannot control case timing in most jurisdictions, so case duration depends on the actions of the judge and the tribunal.

- For international arbitration cases, litigation funders consider an average duration of two to three years as being realistic, with enforcement and possible annulment proceedings not included.

Litigation funding agreement duration

- The duration of the litigation funding agreement may differ from the case duration, but in most cases, the litigation funding agreement will last as long as the case does. However, clients occasionally seek funding after the litigation process has already begun. There is no obligation to sign the litigation funding agreement before the start of the litigation, in which case the two periods will differ.

- Funding may also terminate before the end of the litigation phase by common agreement, or because one party (the client) chooses to terminate the funding agreement early in accordance with the agreement.

Get in touch with one of our experts.

We’ll give you a quick first assessment of your claim.

Is there a minimum claim size?

The minimum claim size required to secure litigation funding can vary depending on the specific funder and the terms of the funding agreement. Some litigation funders may require a minimum claim size of €1 million or more, while others may consider smaller claims on a case-by-case basis, especially when claims are straightforward and incur limited budgets and risk.

Other litigation funders may simply fund claims based on the ratio between the estimated case costs and the potential gains, and not require a minimum claim size.

What percentage do litigation funders take?

As mentioned in the first section, litigation funding works according to a ‘no cure, no pay’ principle –meaning that the funder will only receive compensation if the case is successfully concluded as per the stipulations of success laid out in the contract. If the case is lost, the client will not have to reimburse the funder, and the funder will suffer a net loss.

If the case concludes successfully, the funder's remuneration will be calculated either as a percentage of the total underlying claim value secured or as a return on of the amount

Invested in the case. It could also be a blend of these two approaches. The type of remuneration will depend on the type of claim, agreed control rights, enforcement issues and whether the case was fully or partially funded.

Who makes key decisions?

Upon agreeing to fund a case, the funder is directly interested in its outcome throughout the claim's lifecycle, as developments can impact remuneration and return on investment. As a result, the interests of both the client and the funder are naturally aligned throughout the process: in this context, the successful (most favourable) conclusion of the case.

The funder usually plays a minor role in the case. However, if case management is delegated to the funder, such delegation will only include decisions on day-to-day case management. Strategic decisions, such as accepting a settlement, withdrawing a claim, or filing an appeal, will always require the client’s consent. Depending on the contractual funding terms, the funder may need to be consulted, or consent may be required for certain key decisions that have an impact on the funder’s return.

Within the litigation funding process, the client remains the ultimate decision maker, and funders do not have the right to veto or impose decisions as they are passive investors. However, to mitigate risk on their behalf, funders may lay out caveats to protect their interests within the funding agreement.

As they have an important stake in the outcome of the case, funders will want to be informed of all material developments in the case.

Who selects the lawyer?

Typically, the claimant or their legal representative will select the lawyer who will manage the litigation. However, some litigation funders may require the approval of the lawyer or legal team prior to agreeing to fund the case.

It is within the best interests of the client as well as the funder to work with the most appropriate law firm. Equally, if the client has a preferred law firm that is familiar with the company and has the required expertise to bring the case to a successful conclusion, the funder will normally aim to be flexible and work with the client’s preferred counsel.

Do you want to learn more

about Antitrust Actions?

Why are you entitled to seek compensation when you have been affected by a cartel, an abuse of dominant position or another form of anticompetitive practice? How can you be informed of opportunities to seek compensation? What are the first steps you should take? What should you expect if you decide to participate in an Antitrust Action organized and funded by Deminor? These, and many other questions will be addressed in our Antitrust Actions e-book.

Download the e-book

Considerations when dealing with a third-party funder:

What makes a good funder?

The added value of a good litigation funder can often be seen in the funder’s ability to communicate and provide the best client care during dispute resolution. However, there are also a number of financial and legal considerations that need accounting for when assessing how to choose a litigation funder.

Typical considerations that are often examined before approaching a litigation funder include:

Funder's preferred investment type and specialisms

Funder's preferred investment size

Funder's risk appetite and preferred risk allocation model

Funder's capital reserves to commit to funding the litigation over time

To help with assessing the quality of a third-party funder, litigation funding rankings, such as Chambers & Partners or Leaders League, examine funders within numerous international jurisdictions. While not wholly summative of a funder's quality, these rankings evaluate a litigation funder's team size, specialism, decision-making process, budget availability, awards, accolades and media coverage.

An additional marker of a good funder is whether they are members of associated industry bodies that follow a rule of best practices for litigation funding, such as the International Legal Finance Association (ILFA), the Association of Litigation Funders (ALF), which acts as self-regulatory body for funding within England and Wales, or the European Litigation Funders Association (ELFA), which is the collective voice of funders across Europe,

Regulation of third-party funding

Regulation Restrictions in Certain Jurisdictions

Litigation funding is permitted in most European civil-law countries. Common law countries used to prohibit litigation funding based on the ‘champerty and maintenance doctrine’. These rules prevented the assistance of unrelated third parties in legal claims and the sharing of proceeds with any assisting third parties.

These doctrines have been abolished in the UK, and litigation funding is commonplace in Australia and the United States. In general, however, funders cannot exercise control over the litigation in common-law jurisdictions. Certain common law jurisdictions in Asia, including Singapore and Hong Kong, prohibit the funding of commercial litigation but allow arbitration funding or funding provided to insolvency practitioners. Other Asian countries either permit litigation funding or have not yet regulated it, including Japan, South Korea, Taiwan and China.

Litigation funders must comply with any applicable laws and regulations. Where required, funding agreements need to be adapted to be compliant with any local regulatory restrictions.

Litigation Funding in Europe

Historically, litigation funding has been less known / utilised in continental Europe, although there are some exceptions, such as Germany and Austria. However, more recently, this has been changing as countries such as Spain, Italy, France, Switzerland, to name just a few, have all began using litigation funding much more frequently.

As Common law doctrines of maintenance and champerty did not find their way into the legal system of the continental European jurisdictions, litigation funding is not subject to specific regulations, although procedural, financial, and other regulations relating to mass claims may have an indirect influence.

Do you want to learn more

about Litigation Funding?

Why would a law firm or corporation make use of third-party funding for litigation or arbitration claims? Does it work for all claims? How does litigation funding work and what are the steps from initial assessment to closing of the funding? These and many other questions will be addressed in our Litigation Funding e-book.

Download the e-bookSuggested further podcasts, reading and articles on litigation funding

Litigation Funding in Enforcement and Asset Recovery: Sovereign States

Collective Legal Protection and Litigation Funding in Germany with Dr. Marius...